So you’ve decided to hire a nanny – congratulations! Whatever the reason that you’ve chosen one-on-one care for your child or children, bringing a nanny into your home is infinitely more complicated than taking the kiddos to daycare. I hope that I can help demystify the ins and outs of legally hiring and paying your household employees. There are services out there that play up the complications in order to convince you to pay them to manage your payroll for you, but once you learn to speak IRS, you can do it yourself and save a few bucks.

Please note: The following article contains my own understanding of how the laws regarding Nanny Taxes work. I am not a professional tax preparer, nor have I solicited the advice of one. This article is meant for informational purposes only; please consult your own tax professional for questions regarding your particular situation.

Wait, the IRS knows about this?

For those who may not know, most businesses in the US are required to pay taxes not only on the money they make, but also on the people they employ. Most of these taxes go to fund the federal safety net programs of Social Security, Medicare, and the national unemployment insurance fund. In order for everyone to benefit from these programs, everyone is required to pay in. Most people working outside the home do this directly from their paychecks – the money they owe in taxes comes out before they even get paid. Our employers withhold our share of the responsibility before we ever even see it, making paying those taxes relatively painless. Our pay stubs should detail how much of our pay wings its way to the IRS each pay period, but most people don’t spend much time studying how employment taxes work. The part of the equation we usually don’t see is the total tax that our employers pay in order to keep us working – both to fund those safety nets and to take care of us if they decide to lay us off later. When you hire a nanny, you become an employer yourself, and therefore responsible not only for making sure that your nanny’s taxes get withheld and paid properly, but also for paying your fair share.

Ok, but shouldn’t my nanny just figure this out?

The first question people usually ask is “isn’t my nanny an independent contractor?” There is some complexity to this question, but the basic answer, according to the US Department of Labor, is no. IRS Publication 926, “Household Employer’s Tax Guide,” defines a worker as an employee “if you can control not only what work is done, but how it is done. If the worker is your employee, it does not matter whether the work is full time or part time or that you hired the worker through an agency or from a list provided by an agency or association. It also does not matter whether you pay the worker on an hourly, daily, or weekly basis, or by the job.” In short, if your nanny comes to your home, works the hours you tell them to, feeds your children food you have chosen and puts them to bed when you want them to, they are your employee. An independent contractor has control over the hours they work, the conditions they work under, and how the work gets done. If your nanny is an independent contractor, they can choose to take your kids to R-rated movies or strip clubs, feed them nothing but cotton candy, and let them stay up all night – as long as the kids come home alive, they’ve done their job. Given my preference for which child I’d like to parent at the end of the day, I will gladly choose Option A.

Caring for the caretakers

Do not underestimate the importance of correctly classifying your household workers. If the IRS catches you paying your nanny under the table or giving her a 1099 at the end of the year, you could be required to pay all back payroll, unemployment and federal withholding taxes as a lump sum, plus penalties and interest. Since the economic downturn in 2008, the IRS has prioritized enforcing employee classification laws – and domestic workers are among the most commonly misclassified.

In my opinion, there are even more compelling reasons to undertake the significant work of paying your nanny correctly. Your nanny or nannies are an essential part of your household; you likely chose them carefully, and you are trusting them with the safety and well-being of your children. When you work outside of your home, you are likely protected by a series of employment laws and standards that set minimum work conditions, workplace safety protocols, and rules regarding work hours, breaks, and pay rates. Under federal law, most domestic workers are excluded from these protections. It is up to each employer to treat their household employees fairly and ethically, and one of the ways you can show your employees that you value their work and their care is by supporting them with a financial employment paper trail. To me, this is a no-brainer: I trust my nannies with the life of my child; why would I not do everything in my power to ensure they feel like valued partners in our home?

According to a study released by the National Domestic Workers Alliance in 2012, fewer than 9% of household employees in the US work for someone who pays into Social Security and Medicare on their behalf. Workers paid under the table have no way to prove their work history if they need Disability, unemployment insurance, or many kinds of public assistance. They cannot use that income to qualify for a loan or a mortgage, get a credit card or rent an apartment. As employers, our responsibility is ethically unambiguous; we owe it to our caretakers to do the work required to hire them legally and above-board.

I’m convinced. Tell me about the taxes.

With all of this in mind, let’s examine the different taxes you might have to pay and the thresholds you need to hit in order to owe them. The IRS collects three different kinds of employment taxes: Payroll (Social Security and Medicare, or FICA), Federal Unemployment (FUTA), and Income Tax. (For information about state taxes, see Part 2 of this series.) The amount of money that you owe for each of these taxes depends on how much you pay your domestic employees and if they elect to have you withhold income taxes on their behalf. Unsurprisingly, the rules for each of these three taxes are all different.

- For FICA, if you pay $1,900 or more annually to any one household employee, you are required to pay taxes on that employee’s wages.

- For FUTA, if you pay $1,000 or more per calendar quarter to all your household employees, you are required to pay taxes on the first $7,000 in wages for each employee.

- Household employers are not required to withhold income taxes. However, they can if their employees request it and they agree.

I’ll talk a little bit more about what these taxes are and how to pay them in the next section, but first I have a recommendation: unless you know for certain that you will fall short of these levels, assume that you will owe these taxes and account for them from the very beginning. Household employers only pay these taxes once a year when they file their regular income tax. If you discover later down the road that you didn’t meet the threshold for owing FICA taxes, you will have to pay your employee back any money that you withheld, but that seems far easier to me than having to scramble to come up with enough money to pay taxes you weren’t counting on.

Forms, forms, records and more forms

Like anything else involving the federal government, hiring your nanny legally involves some paperwork. The first thing you will need is an Employer Identification Number, or EIN. Thankfully, this step is fairly easy, and the IRS provides a way to file online. You will get your number immediately, and the IRS will send a follow-up letter containing the same information. Next, you will need to have your nanny fill out standard employment paperwork. You will need a copy of IRS Form W-4 and DHS Form I-9 . If you work outside your home, these forms should look familiar: you will have filled them out yourself when you started a new job. You should also request to see your nanny’s ID as outlined in the instructions for the I-9. Some employers make copies of these documents, but I usually just write down the numbers for my records and leave it at that.

In my opinion, the most important thing you can do for yourself is keep careful, accurate, and timely records. These don’t have to be elaborate, but you should try to maintain a paper trail of the most basic information in a format that is easy for you to understand. For myself, I have my nannies (I have two) fill out a time sheet each week with their start and stop times and the total hours worked. I do the payroll calculations directly on that sheet, and then enter all the info into a spreadsheet that helps me track totals by week. I have an accordion file where I keep all the paperwork – tax forms, contracts, completed time sheets, as well as my EIN and state ID number and the usernames and passwords for all my various accounts. My spreadsheet also has a section where I record payments to the state and federal revenue departments as I make them. I update these two files weekly, and I do my best to ensure that everything having to do with my employees is in one or both of them. If your desk is anything like mine, papers go onto it and then disappear into the black hole at the center of the galaxy. Every week I have to fight my natural tendency toward entropy, but if I ever get audited it will have been worth it.

Doing the math

After all of that, actually calculating the taxes you owe is pretty easy. The tax percentages for 2015 for FICA taxes are: Social Security, 12.4%, and Medicare, 2.9%. These taxes are split evenly between employer and employee – so each party pays 6.2% and 1.45%, respectively. Publication 926 includes a handy chart that calculates these numbers for you, or you can just do the math. FUTA tax is a straight 6%, paid entirely by the employer. Lastly, employees have the option of requesting that you withhold federal income taxes, although you are not required to by law. The amount withheld depends on the number of elections the employee takes on their W-4 form. IRS Publication 15 (Circular E) has pages of tax tables that show exactly how much to deduct based on pay frequency, filing status, and amount.

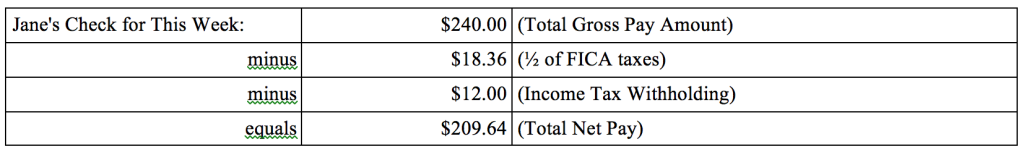

Let me walk you through it. Say I hire one nanny, Jane Doe. She is single and claims one election on her W-4. I pay her once a week, at a rate of $10/hr. In this week, she works 24 hours, for a total of $240.

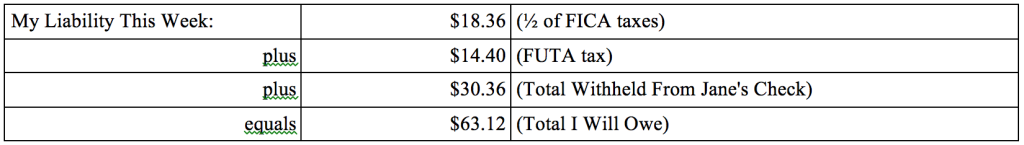

- FICA: $240 x .062 = $14.88 for Social Security. $240 x .0145 = $3.48 for Medicare. $14.88 + $3.48 = $18.36. That means that I will withhold $18.36 from Jane’s paycheck, and I will owe an additional $18.36.

- FUTA: $240 x .06 = $14.40 for federal unemployment. I owe the entirety of this amount.

- Income Tax: I look up $240 on the Wage Bracket Table in Publication 15, and see that for a single person, one election, and weekly payroll, the total withholding is $12. I will withhold this from Jane’s check and deposit it on her behalf.

What does all this mean?

Meanwhile:

If I am smart, I will put aside the amount I owe every week as it accrues so that I’m not totally screwed at the end of the year. Please note that this is for FEDERAL taxes only. Many states also require you to pay unemployment insurance taxes and state income tax as well.

Let’s recap: You have decided to hire a nanny. You have acquired an EIN, checked to make sure your nanny can legally work in the US and had them fill out a W-4 and I-9. You have determined that you will pay this person more than $1,900 for the year and more than $1,000 per quarter, and therefore are liable for FICA and FUTA taxes. Each payroll period, you have done the math to withhold the appropriate amount of money from your nanny’s check, and you’ve figured out how much additional tax you will owe. Now what?

So how do I pay all this stuff?

Except for some special circumstances, the IRS only requires household employers to report and pay taxes at the end of the year along with their regular income taxes. You will need to complete a Schedule H to file with whatever version of the 1040 you use. The Schedule H, a 2-page worksheet, basically goes over the same questions that we have covered already in this article. If you have kept careful records, it should take you less than 10 minutes to answer the questions and determine how much you owe. Pay careful attention to the instructions for the FUTA tax, because you can potentially get credit for payments you made to your state unemployment fund against the amount you owe federally.

In addition to paying a lump sum when you file your taxes, there are a couple of other ways that you can cover what you owe without having to diligently save money all year. The easiest if you work as an employee for someone else is to go to your HR department and fill out a new W-4, increasing the amount that your employer withholds on your behalf. This additional withholding can be used to balance out the taxes that you owe. If you are self-employed or run your own business, you can also counteract your employment taxes with a loss that your business might take for the year. The more deductions you can take, the less tax liability you will have overall. And lastly, you may be eligible for the Child and Dependent Care Credit, depending on your income and how much you spend on child care while you are working.

Anything else I have to do?

Finally, there are a few end-of-year paperwork items to take care of. Employers must provide each employee a Form W-2 (copies B, C, and 2) and information regarding the Earned Income Credit. There is a statement about the EIC on the back of Copy B of the W-2, and if you provide this copy to your nanny your obligation is considered fulfilled. You can also provide your employee with a copy of Notice 797 or a statement of your own that conveys the same information. You are also required to file Form W-2 Copy A and Form W-3 with the Social Security Administration. Thankfully, the SSA has provided a way to do this online, and once you register for an account you have access to a number of tools that will help you file your official copies and offer you the opportunity to print the copies you need to give your employee and the one you should keep for your records.

As difficult as it may be to believe, this article contains only the basic steps that you need to follow in order to hire, pay, and tax your nanny legally. There are special rules covering what you should do if your nanny is a relative of yours, if you pay your nanny taxes along with the tax you pay for your business or farm, what you should do if you want to pay estimated taxes quarterly, and a number of other scenarios. I hope that the information I have provided here can empower you to take on this chore, and to understand what you need to do and why. For more complicated situations or if you have questions regarding the things I have outlined here, I recommend that you talk to a CPA or certified tax preparer who may be able to address your needs better than I can. In the second part of this series, I will talk about the requirements for filing state taxes in Minnesota, and how those requirements might apply to other states.